Silver Divorce: Three experts help you understand what you need to know

read

Divorce among couples where one or both spouses are over age 50 has increased dramatically in the last few years. The challenges that lawyers and financial advisors face when working with clients going through a “Silver Divorce” can be extremely daunting. In fact, many professionals on whom the Courts rely simply don’t have the expertise or experience to effectively address the overwhelming complexities that often arise in such cases – particularly those around Real estate, taxes, and Qualified Retirement Plans.

To fill this gap: The team at silverdivorce.law are experts who support family lawyers, CPAs, and financial advisors in their efforts to help their clients navigate through a silver divorce without experiencing the devastating financial consequences and/or extremely long timelines associated with so many divorces that involve older couples.

To watch, click here to send us an email, and we’ll give you the password. — Pete, Barry, and Mary Jo

ABOUT THE EXPERTS: www.SilverDivorce.law

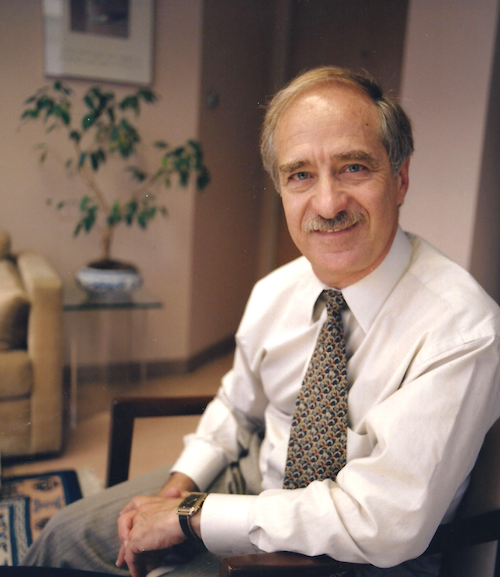

Actuary Peter Neuwirth

Peter J. Neuwirth FSA, FCA, is an actuary specializing in retirement plan issues. He is a 1979 graduate of Harvard College with a BA in Mathematics and Linguistics. After leaving Harvard, he went to work at Connecticut General Life Insurance, now CIGNA. For the next 38 years, he worked as an actuary in significant leadership positions Aon, Hewitt Associates, Watson Wyatt, Towers Perrin, and Towers Watson. He spent 5 years as a chief actuary at Godwins, 7 years at Coates Kenney, and a year at Price Waterhouse. In 2016, Pete retired from Towers Watson to focus on writing and researching financial wellness issues, including using home equity to generate retirement income. In 2018 he taught a graduate seminar on this subject for the actuarial science department at the University of California at Santa Barbara. He is currently associated with the Academy for Home Equity in Financial Planning at the University of Illinois. In addition to his books “Money Mountaineering” and “What’s Your Future Worth?” Pete’s research has been published in the Journal of Deferred Compensation, Contingencies, and the Journal of Financial Planning. He is a Fellow of the Society of Actuaries and the Conference of Consulting Actuaries and is a frequent speaker at the Conference of Consulting Actuaries, Enrolled Actuaries, and Western Pension and Benefits Conference.

Barry H. Sacks

Attorney Barry Sacks Ph.D., earned his Ph.D. in semiconductor physics from M.I.T., then taught at U.C. Berkeley. He earned a J.D. from Harvard Law School and is a Certified Specialist in Taxation Law from the California Board of Legal Specialization. After spending 35 years as an ERISA attorney specializing in qualified retirement plans, he used his breadth of skills to discover a role for a reverse mortgage to help make a retirement portfolio last longer. Barry now has a law practice providing special services to tax professionals in the area of “Offers in Compromise” for retirees living on 401(k) accounts or securities portfolios. With his brother, Professor Stephen Sacks, Barry published the pioneering research paper modeling a strategy that uses reverse mortgage credit lines to mitigate the effects of adverse sequences of investment returns in retirement accounts (Journal of Financial Planning, February 2012). A sequel to this paper expanding the range of applications of the strategy was co-authored by Peter Neuwirth, FSA, and Stephen Sacks. While developing his model for reverse mortgages in retirement income planning, Barry became aware of the particular needs of retirees and soon-to-be retirees in divorce. These needs are of special concern in cases where the retirement savings are divided between the parties or where one of the parties has received most of the retirement savings but not much of the value of the home equity. Barry is a frequent speaker on these subjects.

Mary Jo Lafaye

Mary Jo Lafaye is a licensed Home Equity Conversion Mortgage (HECM) Specialist with Mutual of Omaha Mortgage. She has decades of experience in the reverse mortgage field, including 7 years with Security One Lending and 5 years with Wells Fargo Home Mortgage. She earned numerous awards, including Wells Fargo Leader’s Club Member, with the highest customer service scores. She was chosen to train Private Bankers and Wealth Management Advisors on ways to employ this repayment-deferred line of credit as a retirement planning and cash-flow management tool to create more sustainable income throughout retirement. She is well-known to retirees in California’s Bay Area, where she taught HECM concepts to real estate finance students at the College of San Mateo. Mary Jo has participated in panel discussions and delivered hundreds of seminars and talks to groups ranging from the Retired Firemen’s Association, Kaiser Permanente, Rotary Club, CPA Discussion Groups, CalCPA, SILVAR, SAMCAR, FPA, MAR, NorBAR, NAPFA, PFAC, and the Marin County Bar Association. She is certified to offer complimentary one and two-hour Continuing Education (CE) classes for CFPs, CPAs, and Realtors.