Silver Divorce: Qualified Retirement Plans — Defined Benefit Pension

read

In this 25-minute webinar, Peter Neuwirth explains Qualified Retirement Plans Defined Benefit Pension in Silver Divorce.

To watch, click here to send us an email, and we’ll give you the password.

Peter J. Neuwirth FSA, FCA, is an actuary specializing in retirement plan issues. He is a 1979 graduate of Harvard College with a BA in Mathematics and Linguistics. After leaving Harvard, he went to work at Connecticut General Life Insurance, now CIGNA. For the next 38 years, he worked as an actuary in significant leadership positions Aon, Hewitt Associates, Watson Wyatt, Towers Perrin, and Towers Watson. He spent 5 years as a chief actuary at Godwins, 7 years at Coates Kenney, and a year at Price Waterhouse.

In 2016, Pete retired from Towers Watson to focus on writing and researching financial wellness issues, including using home equity to generate retirement income. In 2018 he taught a graduate seminar on this subject for the actuarial science department at the University of California at Santa Barbara. He is currently associated with the Academy for Home Equity in Financial Planning at the University of Illinois.

In addition to his books “Money Mountaineering” and “What’s Your Future Worth?” Pete’s research has been published in the Journal of Deferred Compensation, Contingencies, and the Journal of Financial Planning. He is a Fellow of the Society of Actuaries and the Conference of Consulting Actuaries and is a frequent speaker at the Conference of Consulting Actuaries, Enrolled Actuaries, and Western Pension and Benefits Conference.

Learn more at SilverDivorce.law and PeterNeuwirth.com.

Silver Divorce: Three experts help you understand what you need to know

read

Divorce among couples where one or both spouses are over age 50 has increased dramatically in the last few years. The challenges that lawyers and financial advisors face when working with clients going through a “Silver Divorce” can be extremely daunting. In fact, many professionals on whom the Courts rely simply don’t have the expertise or experience to effectively address the overwhelming complexities that often arise in such cases – particularly those around Real estate, taxes, and Qualified Retirement Plans.

To fill this gap: The team at silverdivorce.law are experts who support family lawyers, CPAs, and financial advisors in their efforts to help their clients navigate through a silver divorce without experiencing the devastating financial consequences and/or extremely long timelines associated with so many divorces that involve older couples.

To watch, click here to send us an email, and we’ll give you the password. — Pete, Barry, and Mary Jo

ABOUT THE EXPERTS: www.SilverDivorce.law

Actuary Peter Neuwirth

Peter J. Neuwirth FSA, FCA, is an actuary specializing in retirement plan issues. He is a 1979 graduate of Harvard College with a BA in Mathematics and Linguistics. After leaving Harvard, he went to work at Connecticut General Life Insurance, now CIGNA. For the next 38 years, he worked as an actuary in significant leadership positions Aon, Hewitt Associates, Watson Wyatt, Towers Perrin, and Towers Watson. He spent 5 years as a chief actuary at Godwins, 7 years at Coates Kenney, and a year at Price Waterhouse. In 2016, Pete retired from Towers Watson to focus on writing and researching financial wellness issues, including using home equity to generate retirement income. In 2018 he taught a graduate seminar on this subject for the actuarial science department at the University of California at Santa Barbara. He is currently associated with the Academy for Home Equity in Financial Planning at the University of Illinois. In addition to his books “Money Mountaineering” and “What’s Your Future Worth?” Pete’s research has been published in the Journal of Deferred Compensation, Contingencies, and the Journal of Financial Planning. He is a Fellow of the Society of Actuaries and the Conference of Consulting Actuaries and is a frequent speaker at the Conference of Consulting Actuaries, Enrolled Actuaries, and Western Pension and Benefits Conference.

Barry H. Sacks

Attorney Barry Sacks Ph.D., earned his Ph.D. in semiconductor physics from M.I.T., then taught at U.C. Berkeley. He earned a J.D. from Harvard Law School and is a Certified Specialist in Taxation Law from the California Board of Legal Specialization. After spending 35 years as an ERISA attorney specializing in qualified retirement plans, he used his breadth of skills to discover a role for a reverse mortgage to help make a retirement portfolio last longer. Barry now has a law practice providing special services to tax professionals in the area of “Offers in Compromise” for retirees living on 401(k) accounts or securities portfolios. With his brother, Professor Stephen Sacks, Barry published the pioneering research paper modeling a strategy that uses reverse mortgage credit lines to mitigate the effects of adverse sequences of investment returns in retirement accounts (Journal of Financial Planning, February 2012). A sequel to this paper expanding the range of applications of the strategy was co-authored by Peter Neuwirth, FSA, and Stephen Sacks. While developing his model for reverse mortgages in retirement income planning, Barry became aware of the particular needs of retirees and soon-to-be retirees in divorce. These needs are of special concern in cases where the retirement savings are divided between the parties or where one of the parties has received most of the retirement savings but not much of the value of the home equity. Barry is a frequent speaker on these subjects.

Mary Jo Lafaye

Mary Jo Lafaye is a licensed Home Equity Conversion Mortgage (HECM) Specialist with Mutual of Omaha Mortgage. She has decades of experience in the reverse mortgage field, including 7 years with Security One Lending and 5 years with Wells Fargo Home Mortgage. She earned numerous awards, including Wells Fargo Leader’s Club Member, with the highest customer service scores. She was chosen to train Private Bankers and Wealth Management Advisors on ways to employ this repayment-deferred line of credit as a retirement planning and cash-flow management tool to create more sustainable income throughout retirement. She is well-known to retirees in California’s Bay Area, where she taught HECM concepts to real estate finance students at the College of San Mateo. Mary Jo has participated in panel discussions and delivered hundreds of seminars and talks to groups ranging from the Retired Firemen’s Association, Kaiser Permanente, Rotary Club, CPA Discussion Groups, CalCPA, SILVAR, SAMCAR, FPA, MAR, NorBAR, NAPFA, PFAC, and the Marin County Bar Association. She is certified to offer complimentary one and two-hour Continuing Education (CE) classes for CFPs, CPAs, and Realtors.

Decumulation and Silver Divorce: “Spike Expense Risk” and 3 other risks

read

In 2020, I wrote a series of short essays expanding on each of the 6 principles of Holistic Financial Wellness that I outlined in my book, “Money Mountaineering.” These essays were intended to help readers understand how each principle might operate in practice as well as give me a chance to update what I had written for how the world and my thinking about these principles had changed in the months between the submission of my manuscript to the publisher and the day that the book became available to the general public. Click here to read those essays.

In essay #6, Optimism Bias, I shared my perspective on the financial consequences of my own divorce, a contingency that I had carefully considered before I got married, but because of “optimism bias,” had inadequately prepared myself for. I want to go beyond what I shared last year and discuss how divorce is an example of what I consider “Spike Expense Risk” – a risk that has been largely ignored by financial analysts and researchers but can have grave consequences for all retirees.

While marriage can fall apart at any time in one’s adult life, experiencing a divorce when one is older and has retired from full-time employment can be particularly disruptive. Unfortunately, “Silver Divorce” has become increasingly common and a subject of much study and discussion. For those interested, click here to read about the perspective my collaborators and I are providing to that discussion.

Today, however, I want to talk more about the actuarial aspects of “spike expense risk”, and how important it is to consider that risk along with the other unique decumulation risks when planning for retirement or to advise clients on their retirement income strategy

In the months since “Money Mountaineering” was published in October 2021, I have spent much of the last year speaking virtually and in the “real world” to thousands of people about my ideas and how others might use my insights to help individuals navigate through the financial wilderness. It has been a wonderful experience, far more enjoyable than I could have expected, but I am now back home. I have been spending much of my time researching and writing about the unique financial risks that are present after an individual stops working full time, where they accumulate assets and begins drawing down those assets and enters the “decumulation” phase of life.

In the months since “Money Mountaineering” was published in October 2021, I have spent much of the last year speaking virtually and in the “real world” to thousands of people about my ideas and how others might use my insights to help individuals navigate through the financial wilderness. It has been a wonderful experience, far more enjoyable than I could have expected, but I am now back home. I have been spending much of my time researching and writing about the unique financial risks that are present after an individual stops working full time, where they accumulate assets and begins drawing down those assets and enters the “decumulation” phase of life.

Planning for Retirement: Accumulation vs. Decumulation

With tens of millions of Americans now retired and tens of millions more planning/hoping to retire in the next decade, it has become critical for investment advisors and financial planners to communicate clearly about the significant differences between planning strategies that are most effective while an individual is living on their employment income and accumulating assets to be used in retirement and the decumulation phase of life when an individual needs to begin drawing down those assets to sustain themselves for the rest of their life.

While both aspects of retirement planning focus on ensuring sufficient income during retirement, the decumulation problem is distinctly different from the challenge of accumulating assets during one’s working years

The most obvious difference is that during the accumulation phase, the individual’s cash flow is positive (e.g., 401(k) deferrals, company contributions, and personal savings). During decumulation, cash flow is negative (e.g., withdrawals from 401(k), savings accounts, and other personal assets like Home Equity Cash Value Life Insurance policies, etc.).

Less obvious is that the time horizons differ in that the end point of accumulation (i.e., retirement date) is (usually) within the individual’s control. The endpoint of decumulation is determined by life contingencies (e.g., death) and is governed by random variables that are not easily calculable on an individual basis.

Financial Risks Unique to Decumulation

There are 6 distinct financial risks that a retiree faces as they try to sustain themselves for the remainder of their lives. Because of the cashflow and time, horizon differences just noted, only the first two of those 6 are present during the accumulation phase.

Specifically, there is a large body of investment theory addressing inflation/investment risk during the accumulation phase beginning with Harry Markowitz’s Modern Portfolio Theory and the many refinements added in the last few decades.

There is also a significant body of literature on investment/asset allocation strategies that protect against investment liquidity risk while accumulating assets for retirement. Investment liquidity risk is a second distinct risk that must be considered along with inflation/investment risk during both accumulation and decumulation and reflects the risk that changing the asset allocation of an investment portfolio could require selling an investment in a down market.

Once an individual begins decumulating assets (i.e. retires and begins to draw down assets to meet living expenses), 4 more risks that were either non-existent or immaterial while the individual was accumulating assets begin to rear their ugly heads.

The four separate risks that are highly significant just during decumulation are:

- Sequence of Returns Risk

- Longevity Risk

- Tax Risk

- Spike Expense Risk

What follows is a brief description of each and some commentary on the approaches that might be most effective for mitigating each. It is important to note, however, that decumulation remains a very hard problem – one with no “closed form” solution and one where research so far (focusing on just decumulation) has been very limited and, at least for the foreseeable future, it seems unlikely that a comprehensive general strategy can be developed to address all 4 risks for every (or even most) people who are developing financial plans for their retirement years.

Sequence of Returns Risk

Sequence of Returns Risk is a risk well studied by actuaries and others, but until recently, it was not recognized as being vitally important in decumulation while being largely immaterial (from a planning perspective) while accumulating assets

Sequence of returns risk applies, by definition, to retirees whose primary source of income is a securities portfolio — typically, but not necessarily, a 401(k) account or a rollover IRA.

It is the risk that arises from the confluence of 2 factors: 1) The volatility of the securities portfolio from which the retiree is distributing income, and 2) The need to sell some of the securities to meet living expenses when the portfolio is at a low point in its volatility cycle.

Selling low is, of course, the route to premature portfolio exhaustion.

The good news is that research has shown that this risk can be addressed for many retirees with a drawdown strategy that utilizes a “coordinated strategy,” which incorporates an asset whose return is uncorrelated with the invested portfolio. An example of such assets is a Home Equity Conversion Mortgage (“HECM”) that can be drawn on rather than the portfolio when the portfolio is down

Longevity Risk

Longevity risk is theoretically present during the accumulation phase, but, as with sequence of returns risk, the risk of outliving one’s assets is much more significant during the decumulation phase. Unlike most other retirement risks, longevity risk grows dramatically more acute over time as individuals age and stay healthy. Throughout the decumulation phase, longevity risk becomes exponentially more important – especially as the retiree attains an age where expected mortality increases significantly.

This dynamic aspect of longevity risk is rarely addressed, even in the actuarial literature, and most mitigation approaches (e.g., annuitization) tend to be financially inefficient. As a result, a more targeted approach to addressing this risk is needed. Fortunately, some approaches show promise for cost-effectively mitigating longevity risk.

For example, the purchase of a QLAC (pure longevity insurance) is one possibility, but the question of when, during decumulation, to purchase a QLAC is tricky. Too early in retirement and the “premium” for such insurance may be too high (from a purely actuarial perspective), but waiting too long may make the purchase prohibitively expensive relative to the resources that a retiree may have available

Maintaining a buffer asset appears to be a potentially more practical alternative, but as with most life contingencies, direct insurance of the risk appears to be a more efficient means of mitigating the risk

For buffer assets, the challenge is to preserve the asset’s value while maintaining a desired standard of living, while the challenge of using annuity products is cost and timing

Tax Risk

While tax is almost always a very important consideration for an individual as they accumulate assets in anticipation of retirement, it is far beyond the scope of this essay to discuss the results of that research or the extraordinary complexity and variety of effective tax strategies that have been and continue to be developed by tax experts spanning an individual’s complete lifespan and beyond.

When considering that range of strategies and how they might be rendered more or less effective as the tax laws change, it is important to reflect again on one of the fundamental differences between an individual’s situation during the decumulation phase versus their situation while they are accumulating assets and have yet to begin distributions from each of the assets that they will own when they stop working.

Because, by definition, those in retirement will be receiving cash from either debt they take on (e.g., a Reverse Mortgage), assets that they have already accumulated (e.g., 401(k), IRA, etc.), or from a 3rd party by contract (e.g., annuity, social security, employer-provided pension, etc.) there will be substantially more variability and less control that an individual has concerning their annual tax expense after retirement than before.

Therefore while tax risk is very much present during the accumulation phase of life, once an individual stops working and begins decumulating assets, this risk becomes both more significant and less manageable, and as a result, I believe that it is useful for retirees to consider not just tax planning but also “tax expense risk” mitigation.” Annual Tax Expense has not, to my knowledge, ever been considered a unique risk during decumulation to be addressed from an actuarial perspective in the same way that longevity and sequence of returns risk have been. Yet, it seems that the actuarial perspective may be useful here as well – considering a retiree’s annual tax expense as a random variable subject to many uncertain and hard-to-predict factors whose likelihood is hard, if not impossible, to estimate (e.g., the possibility that future marginal tax rates will change via future law changes). During the accumulation phase, long-term tax expense will only have a major impact on the level and mix of the accumulated assets an individual will retire with, while in the decumulation phase, annual tax expense will directly impact both the retiree’s lifestyle and the risk of a retiree outliving their resources.

There don’t appear to be any “pure insurance” solutions to this problem. Still, one area of some potential is converting a Traditional/Rollover IRA into a Roth IRA and considering the upfront cost of conversion as an insurance premium against the future volatility of the tax expense associated with distributions from a Traditional/Rollover IRA. Initial research results are promising, but much more work needs to be done before anything definitive can be said.

Spike Expense Risk

Finally, we come to perhaps the most important understudied decumulation risk – the risk that a well-designed and well-executed retirement income strategy can be completely derailed due to unexpected “spikes” in necessary living expenses while drawing down one’s assets. Mathematically, this risk is equivalent to amplifying sequence of returns risk with two other unfortunate aspects – first, that the incidence, frequency, and magnitude of the spikes are subject to variability that is very hard to model, and second that the aggregate magnitude of the spikes an individual experiences throughout retirement may be significant enough to warrant long term adjustments to one’s ongoing lifestyle expectations and/or basic draw down strategy (e.g., how much of an annual draw to take each year).

Note that each spike risk might need to be addressed separately. Divorce is a spike risk that can be addressed via techniques referred to earlier when “Silver Divorce” was discussed. Specific insurance products or riders on existing policies might be purchased for others (e.g., the potential for Long Term Care). Still, many possible spikes (a family crisis or the impact of a natural disaster) are not insurable or manageable.

The real challenge for Financial Planners is to enumerate for each individual the range of possible spikes that might affect them and ensure adequate attention has been paid to each. Since it is impossible to enumerate all possibilities, our current research into possible risk mitigation techniques includes reducing annual draws and/or setting aside a “buffer asset” to absorb the impact of possible spikes partially, but as with Tax expense risk, much work remains to be done

Concluding Thoughts

The decumulation problem is one of the most important retirement planning challenges facing individuals and those organizations involved in assisting people with their financial plans. In some sense, it is still an open research problem for which only partial/incomplete solutions have been developed.

In my view, the fundamental nature of the decumulation problem is different than that of the accumulating assets for retirement. While the extensive body of investment/asset allocation theory developed over the last 50 years is often applicable, decumulation is more of a risk management problem where actuarial science and the techniques developed by actuaries should be brought to bear.

At its core, decumulation is an asset/liability and cashflow matching problem governed by random variables from unruly and difficult-to-determine probability distributions. It will take the efforts of both researchers in the investment and actuarial professions to make progress.

This challenge and the scope of potential research on decumulation in this area are significant. The benefits of making progress are vitally important to millions of current and future retirees.

Using Housing Wealth and Qualified Retirement Benefits to Facilitate Asset Division in ‘Silver Divorce’

read

SUMMARY OF THE CONTENT OF THE ACTIVITY

By Barry H. Sacks, Peter Neuwirth, and Mary Jo Lafaye

A Note from the Authors/Presenters: We are happy to welcome you to a two-hour program entitled “Using Housing Wealth to Facilitate Asset Division in ‘Silver Divorce.’” It is approved by the California State Bar as a presentation for two hours of MCLE and by the Certified Financial Planner Association as a Continuing Education class for CFPs and other financial professionals.

The program is divided into five segments:

Actuary and Author Peter Neuwirth, FSA, FCA

The First Segment: The first segment of the program is an introductory segment providing the foundation for the subsequent segments. It points out the substantial prevalence of “Silver Divorce” (i.e., divorce among couples where one or both parties are age 50 or greater) and notes that by that age, couples generally have accumulated some wealth in the form of home ownership and retirement assets and/or accrued benefits (often in the form of a 401(k) account, a defined benefit pension accrual, or a rollover IRA). This introductory segment also provides some basic information about reverse mortgage loans. In addition, by the age of Silver Divorce, the divorcing couple’s children, if any, have grown up and are independent of the couple. As a result of that accumulation, the primary focus of the divorce is generally the division of those assets. In addition, after the assets are divided, the concern of each of the parties (and of their advisors and advocates) is to ensure adequate cash flow during retirement (whether impending or already underway).

The Second Segment. The second segment of the program is a series of quantitative examples, illustrating, in a variety of situations, how housing wealth, accessed by means of a reverse mortgage loan, can achieve the following objectives: 1) Facilitate the division of assets; 2) Minimize cash outflow for housing; and 3) Thereby leave adequate cash available for other living expenses. The tax aspects of the transactions in these examples are discussed.

Mary Jo Lafaye, Reverse Mortgage Specialist

The Third Segment. The third segment of the program is a continuation of the second segment, but with retirement cash flow adequacy concerns added to the mix, along with home equity and retirement plan assets. The objectives of this second set of examples are the same as those of the first set of examples. And the tax aspects of the transactions in this second set of examples are discussed.

The Fourth Segment. The fourth segment of the program is a discussion of some of the key actuarial considerations in determining: 1) The value of Defined Benefit (“DB”) pension benefits; 2) The separate and community interests in both DB and DC (Defined Contribution) plans. and 3) Methods to avoid having to utilize a QDRO to facilitate the division of assets.

The Fifth Segment. The fifth segment of the program sets out information on how reverse mortgages work. The intention is to provide practitioners with a better understanding of this financial tool and to dispel many of the widely held misunderstandings.

This program has been presented by the applicants:

- It received MCLE credit when it was presented at a meeting of the American Academy of Matrimonial Lawyers;

- It was also presented at a meeting of the American Association of Divorce Financial Planners.

- In addition, a shorter version was published as an article in the Journal of the American Association for Divorce Financial Analysis.

Barry H. Sacks

Retirement Planning: Generating Lifetime Income, Leaving a Legacy, and the Components of Net Worth Throughout Retirement, Published by the Conference of Consulting Actuaries

readAugust 2022: A Note from Peter Neuwirth — The Conference of Consulting Actuaries published this research paper this month, and my co-authors and I are thrilled. The mention of the paper is featured in a video by CCA President Ellen Kleinstuber. Please click here to read the executive summary, find details about my collaborators Stephen and Barry Sacks, and also read the introduction to our work. We also invite you to link to read the entire paper, where it is published on the CCA website.

Executive Summary

- A number of articles have appeared on the sustainability of inflation-adjusted (constant purchasing power) cash flow during retirement. Various strategies using home equity in conjunction with retirees’ securities portfolios have been analyzed and compared using Monte Carlo simulation.

- These articles demonstrated that, in general, cash flow sustainability is greatly enhanced by using home equity, as compared with not using home equity.

- These articles demonstrated that some strategies for using home equity, in some circumstances, provide greater enhancement of sustainability than other strategies. • More specifically, when home equity, accessed by a reverse mortgage credit line, is used in the “Coordinated Strategy,” and the home value is at least as great as the portfolio value, the probability of sustained cash flow throughout a 30-year retirement is greater than when the “Last Resort Strategy” is used. By contrast, when the portfolio value is greater than the home value, the two strategies provide approximately equal probabilities of cash flow sustainability.

- The previous articles have not considered, in any detail, the legacies left by the retirees nor compared them using the two strategies. This article fills that gap and provides an analysis and comparison. The results show the medians and 10th percentiles of the legacies for each of the three representative retirees using the two strategies.

The previous articles have not considered the composition of the retirees’ net worth during retirement, using each of the two strategies. This article fills that gap and quantifies the extent to which the Coordinated Strategy results in greater proportions of securities in the retirees’ net worth than the Last Resort Strategy. Greater proportions of securities, in turn, provide greater flexibility for the retiree and his/her financial planner to adjust to future changes in economic conditions.

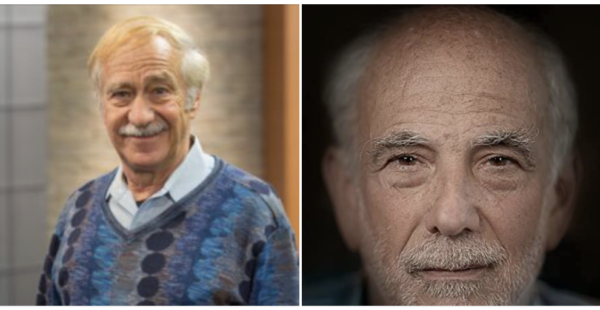

Barry Sacks (left) and Peter Neuwirth (right)

Research and Published Paper by:

Peter Neuwirth, FSA, FCA (pictured right), is an actuary with 43 years of experience in retirement and deferred compensation plans. Recently retired from Willis Towers Watson in San Francisco, he now maintains an independent actuarial consulting practice. He has published numerous articles on deferred compensation, a book on balancing time, risk, and money, and a more recent book on financial planning. Contact: peteneuwirth@gmail.com

Stephen R. Sacks, Ph.D., is a professor emeritus of economics at the University of Connecticut. He maintains an economics consulting practice in New York and has published several articles on operations research and on retirement income planning. Contact: SSacks456@gmail.com

Barry H. Sacks, J.D., Ph.D., (pictured below) is a practicing tax attorney in San Francisco. He has specialized in pension-related legal matters since 1973 and has published numerous articles on retirement income planning and on tax-related topics. Contact: barrys88@yahoo.com

Introduction

Introduction

A number of articles have appeared in this Journal focused on the sustainability of retirees’ cash flow throughout retirement. (see, e.g., Sacks and Sacks 2012; Salter, Evensky, and Pfeiffer 2012; Wagner 2016; Pfau 2016; Neuwirth, Sacks, and Sacks 2017; Walker, Sacks, and Sacks 2021). These articles have focused on retirees whose primary source of income is a securities portfolio (typically, but not necessarily, held in a 401(k) account or a rollover IRA). They have demonstrated that it is possible to enhance the sustainability of cash flow in amounts greater than allowed by the classic “4 percent rule.” This is accomplished by using a “buffer asset” (specifically, home equity accessed by means of a reverse mortgage credit line), in a strategy coordinated with the portfolio in a way that offsets the portfolio’s volatility.

Those articles are based on the Monte Carlo simulation of the investment performance of securities portfolios and of inflation and on the assumption of annual distributions that are inflation-adjusted to have constant purchasing power. Although in several of those articles, there has been some mention of the retirees’ residual net worth or their legacy, none has focused specifically on and explored in depth the measure of residual net worth or legacy of the retirees considered. Moreover, those articles did not examine the individual components that constitute the retirees’ legacy or net worth and the relative proportions of those components.

This article is in three sections: The first section provides a background, summarizing the results of the earlier work on which the second and third sections are based. The earlier work posited three representative retirees, all having the same initial net worth but with different initial values of the components of that initial net worth. The results of the earlier work focused on the retirees’ cash flow survival throughout a 30-year retirement. The second section of this article sets out the results of computations of the values of the representative retirees’ legacies (which would be their net worth amounts) at a range of time points throughout a 30- year retirement. The third section of this article examines the values of the components of the representative retirees’ net worth at the same time points during the 30-year retirement. (The components are the securities portfolio and the home equity.) In this article, as in the previous work, the total value of these assets is expressed by the terms “legacy” and “net worth.” The reason for using two different terms is explained below.

Background

This article continues and draws on the previous work (Sacks and Sacks 2012; Neuwirth, Sacks, and Sacks 2017; Walker, Sacks, and Sacks 2021) in the following ways:

- As in the previous work, the retirees are assumed to have, as their primary assets available to provide retirement income, a portfolio of securities (typically, but not necessarily, in a 401(k) account or a rollover IRA) and home equity (accessed by a reverse mortgage credit line). In this article, as in the previous work, the total value of these assets is used synonymously with the term “net worth.”

- As in the previous work, two strategies for taking distributions from the assets are compared: One strategy called the “Coordinated Strategy,” involves the retiree’s establishing the reverse mortgage credit line immediately upon retirement and taking distributions from the credit line each year immediately following a year in which the portfolio’s investment performance is negative or weak. The other strategy, called the “Last Resort Strategy,” involves the retiree taking distributions only from the securities portfolio until the portfolio is exhausted, and then (if the portfolio is exhausted) establishing the reverse mortgage credit line and taking all subsequent distributions from that credit line.

Click here to read the entire paper.

Principle #5: Hope for the Best, Prepare for the Worst

read

By Peter Neuwirth, actuary, reverse mortgage expert and author, Money Mountaineering

My minder, social media coach, cheerleader, and overall brave new world guru, Julia Page must take some responsibility for this essay about Holistic Financial Wellness Principle #5.

It’s not that she told me what to write. One of the reasons I hired her is because she is so good at letting me be me. I love to write but breaking my thoughts into bite-size memes doesn’t come easily to me, and while Julia tolerates my long-windedness, she told me that I needed to discard my original draft and write a crisper, more focused version of this essay so that it would be both easy to read and helpful to readers who struggle with money issues.

I understand that these days, people have very little time to devote to reading – maybe checking out a link during a break, listening to an idea passed on by a friend, or maybe, if you’re lucky, finding insight from the avalanche of information in your daily feed that will help you solve a problem that is keeping you from making progress.

This seems to be the state of the world and a consequence of the acceleration and compression of the time we are given to solve the problems we face. That is neither good nor bad, and I don’t spend much of my time trying to figure out who or what is to blame – it is just a feature of the world we live in.

And so, this essay, while just as long as the others in this series is focused on the essential task of trying to help you understand the essence of HFW#5 and why it can help you survive and thrive financially.

Holistic Financial Wellness Principle #5 is perhaps the most difficult and counterintuitive of the principles I espouse. In addition to using the word “antifragile” – a word that doesn’t appear in any dictionary you are likely to have in your house, it relies to a great degree on the work of Nassim Taleb, a man who is not easy to understand – particularly the mathematics that forms the rock-solid basis for his conclusions. But just because Dr.Taleb is hard to understand doesn’t mean it is hard to understand what will help you survive and even thrive in a world of Black Swans and fat-tailed distributions. You won’t learn it all here, but at least you’ll get a taste of what Chapter 8 will tell you if/when you end up reading Money Mountaineering.

Fragility, Hidden Risks, and How the World Changes

Fragility, Hidden Risks, and How the World Changes

“I know that history is going to be dominated by an improbable event, I just don’t know what that event will be.” ― Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable

What Dr. Taleb says above has been shown to be the case again and again in the last several thousand years, but it took reading his three books (Fooled by Randomness, The Black Swan, and Antifragile) for me to really get it and start incorporating his insights into how I structured my financial life.

Fooled by Randomness taught me that most of the Probability and Statistics I learned in college and as an actuary, was, at best, incomplete, and, often, downright misleading. The Black Swanwas sobering, but not as disorienting to me since as an actuary I was used to helping my clients protect themselves against things that almost never happen, but reading it helped me appreciate that the low probability/high impact events that do happen are the things that, in fact, change the course of history. This was hammered home by both the Financial Crisis of 2008 and the Pandemic of 2020 – which I think most of us would agree were exactly the kind of Black Swan events that Dr. Taleb talks about.

In 2012 Nassim Taleb published his third book Antifragile. By then I was enough of a fan to buy it as soon as it came out and devoured it immediately, learning that “fat tailed distributions” weren’t just the place where Black Swans come from, but are also the breeding ground for events that can make you stronger when the world changes in dramatic and unexpected ways.

Understanding Nassim Taleb and Using his Insights

Holistic Financial Wellness Principle # 5 says:

“Organizing your financial life to survive a severe economic or life event is essential for long-term financial health. Strive to be antifragile.”

What that means is first and foremost, that you should prepare to survive a potential Black Swan event, and second that you should try and structure your assets and liabilities in such a way that you benefit rather than suffer from the volatility that long term exposure to markets governed by fat tailed distributions will inevitably produce.

When the Financial Crisis of 2008 occurred, I was living and working in Paris, France and had the benefit of being able to watch the financial world crack and crumble from a safe distance. For the first time in my life, I realized that almost everyone who was responsible for “managing” our economy and keeping the global financial system operating didn’t know what was happening and, worse, didn’t know how to stop the wildfire that was destroying corporations, banks and even a giant insurance company (AIG) along with the financial lives of millions of people who were losing their homes, their jobs and even their pensions and retirement savings.

It is easy to forget how scary and uncertain those times were, and though our economy and the markets have recovered, the experience told me that not only can it happen again, but eventually it will happen again – not a “real estate bubble induced financial meltdown” but something else just as unexpected and just as world changing. When the Pandemic of 2020 came ashore and crashed our economy so severely that the country’s unemployment rate increased from under 4% to 14.7% in one month (something that had never happened before) I was ready, or, if not ready, at least prepared enough to not have to worry about by income or my ultimate financial survival.

Now that the economic crisis associated with COVID has passed, or at least morphed into something else, we are beginning to forget again how scared we all were about our money and our jobs and feel that things are getting back to normal – economically at least. Maybe so, but I still think the lessons of these two Black swan events should be incorporated into how we manage our financial lives and I believe that keeping Holistic Financial Wellness Principle #5 in mind can help.

So, what did I do to prepare, and why am I feeling ok financially?

It is because I took a “barbell” approach to my financial life to become antifragile and, through redundancy and insurance, made sure that if one part of my personal balance sheet disappeared, I would still have enough resources to sustain myself and rebuild anything that was lost.

I will tell you, in a minute, a little bit about what I did, but first I want to go slightly deeper into the insights that informed that strategy. From Dr. Taleb’s books, I learned that

- Pronouncements by investment experts about the future behavior of many investment markets that are based on “historical patterns” including those based on capital market assumptions that come from “sample means, sample variances, and sample correlation coefficients” are almost certainly wrong because one of the statistical consequences of being in a fat-tailed distribution is that you will never be able to collect enough historical data to know just how likely or unlikely extreme returns (positive and negative) will be in a given market whether it be soybean futures or cryptocurrency.

- The situation is not as hopeless as the above would suggest because it is possible to gain some insight into the nature and extent of the “fatness” of the tail of a given distribution, and, in particular, it is often possible to determine whether the likely nature of the distribution provides an opportunity for profiting from volatility

It is not at all obvious how to take advantage of item 2 from a theoretical perspective, but as a practical matter, I believe that the concept of using a “barbell strategy” as I describe in Chapter 8 of Money Mountaineering is something to consider.

Beginning in early 2008 I started to model my financial strategy along these lines, first spreading my money among different banks eventually having significant percentages in 4 different major institutions. At the same time, I started to radically diversify my sources of retirement income, eventually obtaining Life Insurance and Annuities from 3 different major insurance companies as well as a Charitable Gift Annuity and a Charitable Remainder Trust from my old school which has an endowment of almost $500 million backstopping the life income that they will begin paying me when I turn 65. It goes without saying, that I also made sure that I had enough insurance to protect me against known contingencies like death, disability and other hazards that are more easily imagined (fire, theft, and being sued).

For the next few years, I didn’t worry too much about my long-term financial security. I had a secure and stable spot in the actuarial profession and was confident I would have enough income to meet my needs and then some until I had to stop working as a W-2 employee. That didn’t happen until 5 years ago when in 2016, my company merged with another giant consulting/brokerage firm, and I decided to take early retirement.

As soon as I retired, I organized my financial life as two barbells. On the one hand, I have a collection of diversified assets that will provide me with a bullet-proof secure and steady income that will be enough for me to live on if I lose everything else. They include the annuities I described above, as well as cash value life insurance, the Pension benefits that I now receive from the companies I had worked for as an actuary, and an old 401(k) plan that is 100% invested in US TIPS (“Treasury Inflation-Protected Securities”).

The above investments comprised a large percentage of my assets, so I don’t have a lot of extra cash to deploy to the other barbell, but what I did have, I deployed into highly speculative investments (mostly collectibles) whose payoff will likely follow “Pareto’s rule” –a form of fat-tailed distribution where most of what you invest in earns nothing or less but every once in a while, you hit a “home run”. Since I didn’t have enough investable assets to construct a true second barbell (e.g., by becoming an “angel investor’ in multiple start-ups) I instead decided to invest my time in lots of different side ventures, most of which will likely come to naught, but any one of which could substantially reward me if they are successful. That is how I apply Holistic Financial Wellness Principle #5.

Get Ready for the Future

These days, Nassim Taleb continues to make his writing available to all who are curious to read about his ideas in real-time. Specifically, if you go to academia.edu and follow him, you will be able to read many of his recent papers, both technical and not. Like many things in life, working through what Nassim Taleb has to offer the world is not easy, but for many of you, it could represent a very smart investment of time and energy.

To provide one recent and particularly timely example, in June of this year, Dr. Taleb posted this paper about bitcoin: https://www.academia.edu/49313911/Bitcoin_Currencies_and_Fragility

This one is not that difficult to read, but if you are not very “mathy” then the explanation of the paper posted by Michael Edesess on Advisor Perspectives in July explaining Dr. Taleb’s work should help. You can read it here: https://www.advisorperspectives.com/articles/2021/07/18/why-nassim-taleb-says-bitcoin-is-worthless

In the last few years, many of my friends and colleagues have wondered why I speak about Nassim Taleb so frequently and with what is sometimes perceived as “missionary zeal”. I hope this essay has provided at least a partial answer.

The truth is that, if and when a true Apocalypse comes, none of what I or Dr. Taleb says will matter much, but until that day arrives, Dr. Taleb’s insights are well worth absorbing– particularly his understanding of the Fat-Tailed Distributions in which we find ourselves embedded in. For me, the message is clear, and to paraphrase what I posted a while ago about risk management in a world governed by fat-tailed distributions:

“If you live your life believing that Life follows a Normal distribution, you will find that things almost never turn out as badly as you fear, except when they turn out much, much worse.”

But things can also turn out much, much better than you expect and that is where antifragility comes in. Perhaps the best way I can explain my approach is to quote the advice my father used to give me throughout my childhood– “Hope for the best but prepare for the worst”. That and his advice to me shortly after I graduated college to “keep as many irons in the fire as you can” are two of the teachings that have allowed me to survive and thrive, in the world of money for over 40 years.

That, essentially is what Holistic Financial Wellness Principle #5 is all about.

About Peter Neuwirth: Since graduating from Harvard with a degree in mathematics and linguistics in 1979, Peter Neuwirth has held actuary leadership positions at consulting firms including Aon, Hewitt Associates, Watson Wyatt Towers, Perrin, and Towers Watson. He also ran the actuarial firm Coates Kenney and spent a year at Price Waterhouse.

About Peter Neuwirth: Since graduating from Harvard with a degree in mathematics and linguistics in 1979, Peter Neuwirth has held actuary leadership positions at consulting firms including Aon, Hewitt Associates, Watson Wyatt Towers, Perrin, and Towers Watson. He also ran the actuarial firm Coates Kenney and spent a year at Price Waterhouse.

Currently a Fellow of the Society of Actuaries and the Conference of Consulting Actuaries, Pete regularly consults with the largest corporations in the world about their retirement plans with a focus on time risk and money. “These fundamental concepts shape our world,” explains Pete, who is a sought-after speaker for professional conferences, and is frequently quoted in national mainstream and trade publications.

After being asked too many times “What is an actuary, exactly?” Pete has written two books to answer another question: “How does an actuary think, and why does it matter?”

His first book, What’s Your Future Worth, is an accessible step-by-step guide to using the powerful concept of Present Value. Pete explains, “My goal is to help readers determine the value today of something that might happen in the future and evaluate outcomes that might arise from choosing one path instead of another.”

In his newest book, Money Mountaineering, Pete shares his views on the challenges we face to survive and thrive in a complex uncertain noisy and sometimes irrational wilderness. “I hope to help readers better understand the financial world they must live in and what they must do to make their way through it,” Pete shares.

Pete is also a senior consulting actuary for CapAcuity a member of the University of Illinois Academy for Home Equity in Financial Planning and the outside director at Rael & Letson. He is a longtime resident of Sana Rosa, CA. Learn more at www.peterneuwirth.com.

Tuesday, September 12th: Free Lunch And Learn

read

TIME: 11:30am-12:30pm

WHERE:

Tiburon Library (Founders Room)

1501 Tiburon Blvd, Tiburon, CA 94920

Join us for a 90-minute update on how to get the funds you need, even in a tight lending environment. With minimal income and credit requirements, you can qualify to receive monthly income:

You will learn:

- for life (tenure) guaranteed by HUD,

- for any term you choose, or

- as a flexible credit-line to draw from as the need arises

- You can even use this non-recourse FHA-insured program, the Home Equity Conversion Mortgage (HECM), or a HomeSafe Jumbo RM to pay off an existing mortgage or HELOC, thereby eliminating your monthly payments for life.

- You retain ownership and can sell your home if you ever choose, or leave all remaining equity to your heirs.

Monday, August 21st: Free Lunch And Learn

read

TIME: 12:00pm – 1:30pm

WHERE:

Left Bank Brasserie

507 Magnolia Avenue,

Larkspur, CA 94939

Join us for a 90-minute update on how to get the funds you need, even in a tight lending environment. With minimal income and credit requirements, you can qualify to receive monthly income:

You will learn:

- for life (tenure) guaranteed by HUD,

- for any term you choose, or

- as a flexible credit-line to draw from as the need arises

- You can even use this non-recourse FHA-insured program, the Home Equity Conversion Mortgage (HECM), or a HomeSafe Jumbo RM to pay off an existing mortgage or HELOC, thereby eliminating your monthly payments for life.

- You retain ownership and can sell your home if you ever choose, or leave all remaining equity to your heirs.

Wednesday, August 23rd: Free Lunch And Learn

read

TIME: 11:00am – 12:30pm

WHERE:

Marin Builder Association

660 Las Gallinas Ave.

San Rafael, CA 94903

Join us for a 90-minute update on how to get the funds you need, even in a tight lending environment. With minimal income and credit requirements, you can qualify to receive monthly income:

You will learn:

- for life (tenure) guaranteed by HUD,

- for any term you choose, or

- as a flexible credit-line to draw from as the need arises

- You can even use this non-recourse FHA-insured program, the Home Equity Conversion Mortgage (HECM), or a HomeSafe Jumbo RM to pay off an existing mortgage or HELOC, thereby eliminating your monthly payments for life.

- You retain ownership and can sell your home if you ever choose, or leave all remaining equity to your heirs.

Monday, August 28th: Free Lunch And Learn

read

TIME: 12:00pm – 1:30pm

WHERE:

Left Bank Brasserie

507 Magnolia Avenue,

Larkspur, CA 94939

Join us for a 90-minute update on how to get the funds you need, even in a tight lending environment. With minimal income and credit requirements, you can qualify to receive monthly income:

You will learn:

- for life (tenure) guaranteed by HUD,

- for any term you choose, or

- as a flexible credit-line to draw from as the need arises

- You can even use this non-recourse FHA-insured program, the Home Equity Conversion Mortgage (HECM), or a HomeSafe Jumbo RM to pay off an existing mortgage or HELOC, thereby eliminating your monthly payments for life.

- You retain ownership and can sell your home if you ever choose, or leave all remaining equity to your heirs.